Shining Light on Solar Financing: A Comprehensive Guide

"Solar Financing Options for Homeowners"

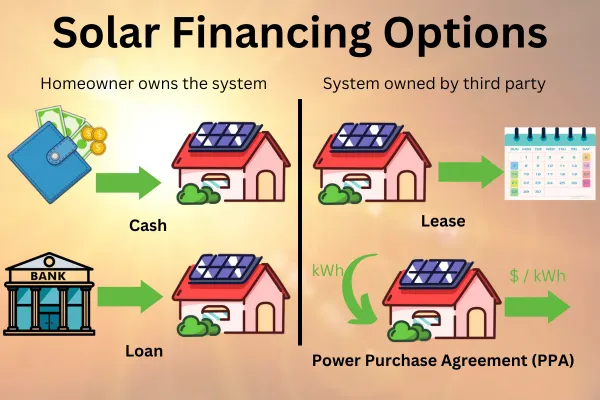

When embarking on the journey towards solar energy, homeowners are presented with a variety of financing options to make this sustainable investment feasible. One such avenue is through the use of cash, providing a direct means of purchasing solar panels without the need for external financing.

By utilizing personal funds or savings, homeowners can take immediate ownership of their solar energy system, reaping the benefits of long-term savings on utility bills and potential tax incentives. Additionally, with the decreasing cost of solar panel installations and the availability of government rebates or incentives in many regions, cash payments offer a straightforward approach to embracing renewable energy while enhancing property value.

For those seeking a more structured financial approach, solar loans present an attractive alternative. These loans allow homeowners to spread out the cost of their solar panel installation over time while potentially benefiting from reduced interest rates compared to other traditional forms of borrowing.

Utilizing tools such as a solar loan calculator can assist in estimating monthly payments and overall costs associated with financing through this method. By delving into these different avenues for solar financing, homeowners can choose an option that aligns with their financial goals and paves the way toward a greener future.

"Cash: A Straightforward Approach to Solar Financing"

When it comes to financing solar energy systems, opting to pay with cash is often considered the most straightforward approach. By paying upfront in cash, homeowners can avoid interest payments and potentially benefit from various incentives or rebates offered for solar installations. While the initial cost may seem significant, the long-term savings on energy bills can offset this investment.

Additionally, purchasing solar panels outright gives homeowners full ownership and control over their system, allowing them to maximize the return on investment by reaping the full benefits of energy savings and potential incentives. For those considering a solar loan to fund their renewable energy project, it's crucial to explore different lenders and compare interest rates for solar loans.

Many financial institutions offer specialized loans tailored for solar installations, with competitive rates and flexible repayment terms. Using a solar loan calculator can help homeowners estimate monthly payments based on loan amount, interest rate, and term length.

This tool assists in determining the feasibility of taking out a loan for solar panels while considering individual financial circumstances. Exploring options beyond purchasing outright also includes investigating solar panel leasing or entering into a Power Purchase Agreement (PPA).

With leasing agreements, homeowners have the opportunity to install solar panels without the upfront costs associated with ownership. Instead of owning the system outright, individuals pay a fixed monthly fee to lease the equipment while benefiting from reduced utility bills.

On the other hand, entering into a PPA involves agreeing to buy electricity generated by a third-party-owned system at an agreed-upon rate. This arrangement offers another avenue for accessing renewable energy without bearing the burden of ownership or maintenance costs.

"Solar Loans: Empowering Homeowners with Renewable Energy"

Solar loans have become a popular choice among homeowners seeking to invest in renewable energy solutions. These loans offer a structured repayment plan that allows homeowners to finance their solar panel installation while spreading out the cost over time.

One of the key advantages of solar loans is that they empower homeowners to own their solar panels outright, allowing them to benefit from both energy savings and potential incentives or tax credits. With various lenders offering competitive interest rates for solar loans, homeowners can choose a loan that fits their financial goals and budget.

Utilizing a solar loan calculator can help homeowners estimate the total cost of their solar project, including interest payments, and determine the most suitable financing option for their needs. In comparison to other financing methods such as solar panel leasing, which involves renting the equipment without ownership rights, solar loans provide homeowners with a sense of ownership and control over their renewable energy investment.

By obtaining multiple quotes for solar panels and comparing loan offers from different lenders, homeowners can make informed decisions about their financing options based on factors such as interest rates, repayment terms, and overall cost savings. Additionally, some financial institutions offer specialized solar loan programs designed specifically for residential customers looking to make environmentally conscious choices while reducing their carbon footprint.

Overall, opting for a solar loan can be a prudent financial decision for homeowners committed to sustainability and long-term energy savings. By taking advantage of competitive interest rates and flexible repayment terms offered by reputable lenders, homeowners can embark on their journey towards energy independence with confidence and peace of mind.

"Unlocking Equity: Cash-Out Refinance or HELOC for Solar Investments"

Unlocking equity to invest in solar energy can be a strategic financial move for homeowners looking to embrace renewable energy solutions. One option to consider is utilizing a cash-out refinance, which allows homeowners to access the equity built up in their home by refinancing their mortgage for a higher amount than they currently owe. By leveraging this equity, homeowners can secure funds to invest in solar panels without taking out an additional loan.

This approach not only simplifies the financing process but also offers potentially lower interest rates compared to other financing options. Additionally, with the investment in solar panels, homeowners may see an increase in their property value, further enhancing their overall financial position.

Another avenue worth exploring is a Home Equity Line of Credit (HELOC) as a means of financing solar investments. A HELOC functions as a revolving line of credit that uses the homeowner's equity in the property as collateral.

This flexible financing option provides homeowners with access to funds as needed, making it ideal for covering the upfront costs of installing solar panels. Interest rates for HELOCs are typically variable but may offer lower rates compared to traditional loans, providing cost-effective financing for solar projects.

By tapping into their home's equity through a HELOC, homeowners can optimize their financial resources and accelerate their transition towards sustainable energy solutions. Combining the benefits of unlocking equity through cash-out refinancing or utilizing a HELOC presents homeowners with versatile strategies for funding their solar investments.

Before proceeding with either option, it is advisable to consult with financial advisors or lenders specialized in renewable energy financing to explore personalized solutions tailored to individual circumstances and goals. By taking proactive steps towards securing funding through these methods, homeowners can embark on their journey towards harnessing the power of solar energy while maximizing the financial advantages associated with renewable technology integration.

"Solar Leases or Power Purchase Agreements (PPA): Flexible Financing Solutions"

Solar leases and Power Purchase Agreements (PPAs) offer flexible financing solutions for homeowners looking to adopt solar energy without the upfront costs associated with purchasing a system outright. Solar panel leasing allows homeowners to essentially "rent" solar panels for a fixed monthly fee, typically with little to no money down.

This option is appealing for those who may not have the capital to invest in a system but still want to benefit from solar energy savings. Additionally, with a PPA, homeowners can enter into an agreement with a solar provider to buy the electricity produced by the system at a predetermined rate.

This arrangement can provide immediate savings on utility bills without the need for upfront investment. Furthermore, when considering solar leases or PPAs, it is important for homeowners to carefully review the terms of the agreement, including lease duration, escalator clauses that increase payments over time, and buyout options if they decide to purchase the system later on.

Understanding how these factors impact long-term savings and overall financial commitment is crucial in making an informed decision. Homeowners should also compare different offers from solar providers and consider consulting a solar loan calculator to assess the total cost of leasing versus purchasing.

Moreover, obtaining a quotation for solar panels through leasing or entering into a PPA involves assessing various factors such as system size, energy production estimates, maintenance costs, and warranty coverage. It is advisable for homeowners to seek multiple quotes from reputable providers and compare not only prices but also service quality and customer reviews.

Additionally, understanding interest rates for solar loans if considering ownership after leasing can provide insight into long-term financial implications. By evaluating all these aspects carefully, homeowners can make an educated choice that aligns with their budgetary constraints and sustainability goals.

Conclusion

As we draw our exploration of solar financing options to a close, it becomes evident that the journey towards harnessing solar power is not just a financial decision but a transformative investment in sustainable living. By delving into the various avenues available to homeowners, from cash purchases to solar loans and leasing arrangements, we have unveiled a spectrum of possibilities for integrating renewable energy into our lives. The quote for solar panels should not only be seen as a monetary transaction but as a commitment to reducing carbon footprint and embracing cleaner energy sources.

With tools like the solar loan calculator aiding in financial planning and understanding interest rates for solar loans, the pathway towards greener living has never been more accessible. As we navigate this evolving landscape of solar financing, let us embark on this journey with optimism, knowing that each step taken brings us closer to a brighter future powered by the sun's boundless energy.

For nearly a decade, we've been delivering top-notch solar and electrical solutions to residences and businesses, regardless of their scale or type. Our family-operated enterprise prioritizes economical solar setup and upkeep, offering a refreshing alternative to the expensive, sales-centric methods commonly seen in New Jersey's solar energy industry.

Call 609-337-4117

Email: info@cleanenergyadvisor4u.com

Site: www.cea4u.solar